Per a report from Cohen & Steers, “real assets have tended to outperform during periods of rising and unexpected inflation, contrasting with the modest or negative inflation sensitivity of stocks and bonds.”

The report argues that real assets can help mitigate the potentially damaging effects of rising inflation, provide diversification potential “from distinct performance drivers that typically result in low correlations, both among real assets categories and vs. stocks and bonds,” and provide “attractive return potential over full market cycles, with a history of attractive risk-adjusted performance.”

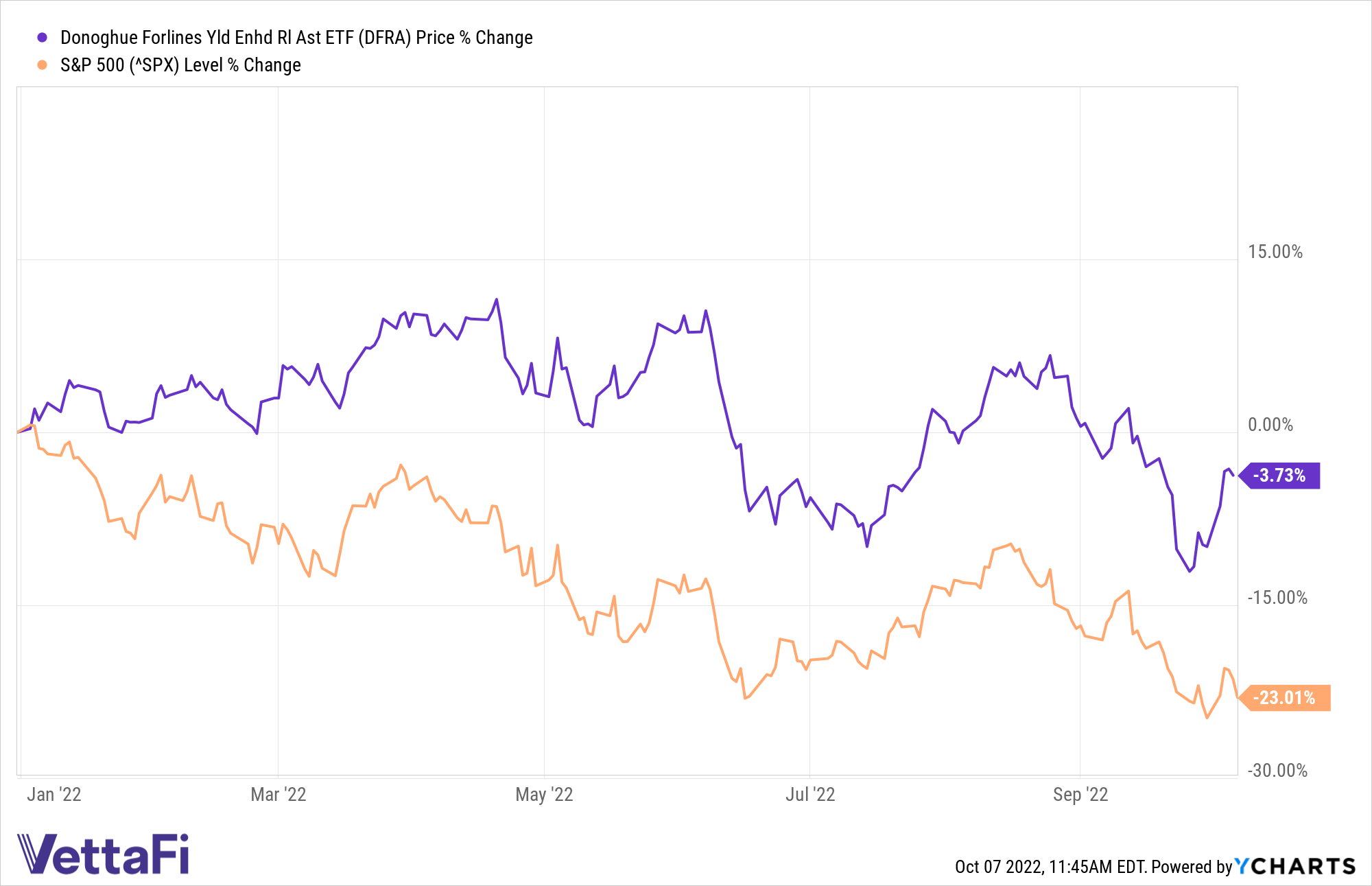

The Donoghue Forlines Yield Enhanced Real Asset ETF (DFRA) finished Q3 as the top large-value fund year-to-date, according to Morningstar. Year-to-date, DFRA is up more than 19 percentage points from the S&P 500. Click here to see DFRA standardized performance.

DFRA seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FCF Yield Enhanced Real Asset Index, an investment strategy developed by FCF Advisors subsidiary FCF Indexes. The driver behind DFRA’s recent outperformance is its underlying index.

“The index invests in high-quality real assets equities based on our Free Cash Flow Quality Model (FCFQM), which identifies companies with strong and sustainable profitability that have historically outperformed in a consistent manner,” said Vince (Qijun) Chen, an investment strategist from FCF Indexes. “By combining free cash flow investing with the goal of inflation hedge and enhanced income generations, the strategy outperforms not only the broad market index like S&P 500 but also the passive benchmark S&P Real Assets Equities Index this year.”

The fund invests primarily in U.S.-listed real asset companies of all sizes. This includes companies related to real estate, infrastructure, commodities, and natural resources.

Eligible securities are scored depending on their ability to generate profit and pay dividends using a fundamental evaluation that includes quality of earnings, free cash flow profitability, and dividend yield. Those that represent the top 25% of the scored equity universe are considered for inclusion.

Target weight is allocated to each security based on the combination of the three factors and market cap. Based on the target weight, the index selects up to 75 stocks or until 90% of the cumulative security weight has been included, whichever occurs first.

DFRA also provides a hedge against inflation as it looks to provide better risk-adjusted returns than broad market equities in periods of positive inflation surprises. It also seeks to generate a higher dividend yield than broad market equities and the market-cap-weighted real asset equities universe, with the potential of continuous dividend payments over the long term.

The fund applies FCF Advisors’ Free Cash Flow Quality Factor Model to seek alpha generation over a market-cap-weighted real asset equity universe.

For more news, information, and strategy, visit the Free Cash Flow Channel.